UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY |

| (AS PERMITTED BY RULE 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

EXELON CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

March 19, 2015

AND 20132015 PROXY STATEMENT

March 14, 2013

To the shareholders of Exelon Corporation:

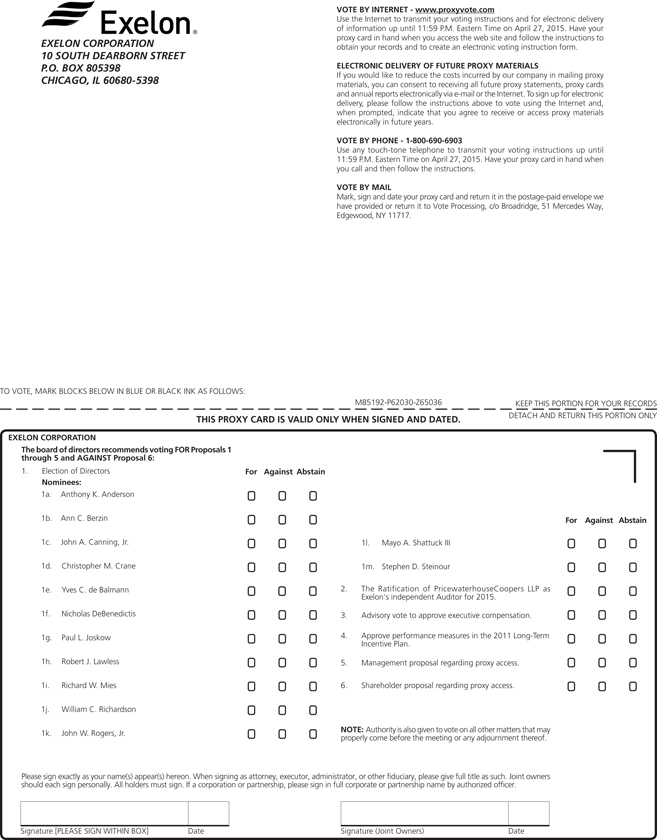

Our Annual Meetingannual meeting of Shareholdersshareholders will be held on Tuesday, April 23, 201328, 2015 at 9:00 a.m. EasternCentral Time in the Sky Lobby Conference Center, 750 E. Pratt Street, Baltimore, Marylandat Exelon Corporation headquarters, 10 S. Dearborn, Chicago, Illinois to:

| 1) | Elect director nominees named in the attached proxy statement; |

| 2) | Ratify PricewaterhouseCoopers LLP as Exelon’s independent |

| 3) | Approve the compensation of our named executive officers as disclosed in the attached proxy statement; |

| 4) | Approve the |

| 5) | Approve the management proposal regarding proxy access; |

| 6) | Vote on a shareholder proposal regarding proxy access, if properly presented at the meeting; and |

| Conduct any other business that properly comes before the meeting. |

Shareholders of record as of March 1, 201310, 2015 are entitled to vote at the annual meeting.

On or about March 14, 2013,19, 2015, we will mail to our shareholders a Notice Regarding the Availability of Proxy Materials, which will indicate how to access our proxy materials on the internet.Internet. By furnishing the Notice Regarding the Availability of Proxy Materials we are lowering the costs and reducing the environmental impact of our annual meeting.

Bruce G. Wilson

Senior Vice President,

Deputy General Counsel and Corporate Secretary

Your vote is important. We encourage you to vote promptly.

Internet and telephone voting are available through 11:59 p.m.

Eastern Time on April 22, 2013.27, 2015.

[THIS PAGE INTENTIONALLY LEFT BLANK]

i

ii

iii

Frequently Asked QuestionsProxy Statement Summary

Why did I receive these proxy materials?

We are providing these proxy materials in connection with the solicitation by the board of directors of Exelon Corporation (“Exelon,” the “company,” “we,” “us,” or “our”), a Pennsylvania corporation, of proxies to be voted at our 20132015 annual meeting of shareholders and at any adjournment or postponement.

You are invited to attend the The annual meeting of shareholders. Itshareholders will take place on April 23, 2013, beginning28, 2015 at 9:00 a.m., Eastern Central Time in the Sky Lobby Conference Center, 750 E. Pratt Street, Baltimore, Maryland.at Exelon Corporation headquarters, 10 S. Dearborn, Chicago, Illinois.

Can I access the Notice of Annual Meeting and Proxy Statement and the 2012 Financial Report on the Internet?MATTERS FOR SHAREHOLDER VOTING

As permitted by SEC rules,At this year’s annual meeting, we are making this proxy statement and our annual report available to shareholders electronically via the internet at www.proxyvote.com. On March 14, 2013, we began mailing toasking our shareholders a notice containing instructions on how to access this proxy statement and our annual report and how to vote online. If you received that notice, you will not receive a printed copy of the proxy materials unless you request it by following the instructions for requesting such materials contained on the notice.

In addition, shareholders may request to receive proxy materials in printed form or electronically by email on an ongoing basis. Exelon encourages shareholders to take advantage of the availability of the proxy materials on the internet in order to save Exelon the cost of producing and mailing documents to you, reduce the amount of mail you receive and help preserve resources.

Shareholders of Record: If you vote on the internet at www.proxyvote.com, simply follow the prompts for enrolling in the electronic delivery service.

Beneficial Owners: You also may be able to receive copies of these documents electronically. Please check the information provided in the proxy materials sent to you by your bank, broker or other holder of record regarding the availability of this service.following matters:

Do I needProposal 1: Election of Directors

The board of directors recommends a ticketvote FOR the election of the director nominees named in this proxy statement. See pages 1 through 11 for further information on the nominees.

Proposal 2: Appointment of PricewaterhouseCoopers LLP for 2015

The board of directors recommends a vote FOR this proposal. See page 32 for details.

Proposal 3: Advisory Approval of Executive Compensation

The board of directors recommends a vote FOR this proposal. See pages 33-76 for details.

Proposal 4: Approve Performance Measures included in Exelon Corporation’s 2011 Long-Term Incentive Plan

The board of directors recommends a vote FOR this proposal. See pages 77-80 for details.

Proposal 5: Approve Management Proposal regarding Proxy Access

The board of directors recommends a vote FOR this proposal. See pages 81-85 for details.

Proposal 6: Shareholder Proposal regarding Proxy Access

The board of directors recommends a vote AGAINST this proposal. See pages 86-88 for details.

The board of directors knows of no other matters to attend the annual meeting?

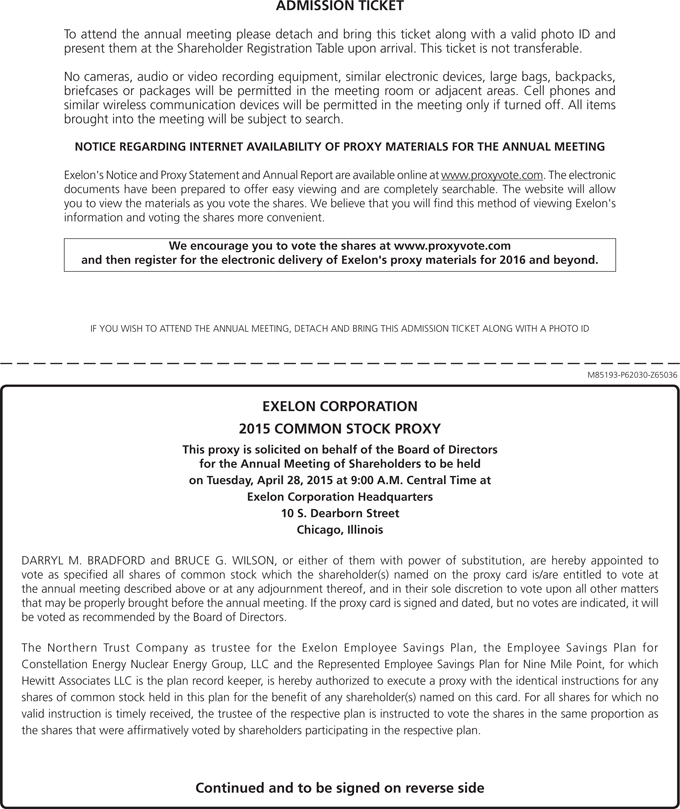

You will need an admission ticket or proof of ownership to enterbe presented for action at the annual meeting. You may presentIf any ofmatter is presented from the following in order to enter: (1) the Notice Regarding Availability of Proxy Materials, which contains instructions on how to access this proxy statement; (2) the bottom half of your proxy card; or (3) if you received your proxy materials through the internet, the e-mail with your control number.

If your shares are held in the name of a bank, broker, or other holder of record and you plan to attend the meeting, you must present proof of your ownership of Exelon stock as you enter the meeting, such as a bank or brokerage account statement. If you would rather have an admission ticket, you can obtain one in advance by mailing a written request, along with proof of your ownership of Exelon stock, to:

Annual Meeting Admission Tickets c/o Bruce G. Wilson, Senior Vice President, Deputy General Counsel and Corporate Secretary, Exelon Corporation, 10 South Dearborn Street, P.O. Box 805398 Chicago, Illinois 60680-5398.

Shareholders also must present a form of personal photo identification in order to be admitted into the meeting.

No cameras, audio or video recording equipment, similar electronic devices, large bags, briefcases or packages will be permitted into the meeting or adjacent areas. Cell phones and similar wireless communication devices will be permitted in the meeting only if turned off. All items brought into the meeting will be subject to search.

1

Who is entitled to vote at the annual meeting?

Holders of Exelon common stock as of 5:00 p.m. New York Time on March 1, 2013 are entitled to receive noticefloor of the annual meeting, andthe individuals serving as proxies intend to vote their shares aton these matters in the meeting. Asbest interest of that date, there were 855,558,753 shares of common stock outstandingall shareholders. Your signed proxy card gives this authority to Darryl M. Bradford and entitledBruce G. Wilson.

Please refer to vote. Each share of common stock is entitled to one votethe material on each matter properly brought before the meeting.

What is the difference between holding shares as a shareholder of record and as a beneficial owner?

If your shares are registered directly in your name with Exelon’s transfer agent, Wells Fargo Shareowner Services, you are the “shareholder of record” of those shares. This Notice of Annual Meeting and Proxy Statement and accompanying documents have been provided directly to you by Exelon.

If your shares are held in a stock brokerage account or by a bank or other holder of record, you are considered the “beneficial owner” of those shares. This Notice of Annual Meeting and Proxy Statement and the accompanying documents have been forwarded to you by your broker, bank or other holder of record. As the beneficial owner, you have the right to direct your broker, bank or other holder of recordpages 89-94 for information about how to votecast your shares by usingvotes, who may attend the voting instruction card or by following their instructions for voting by telephone or on the Internet.

Your vote is important. We encourage you to vote promptly. Internetmeeting, and telephone voting are available through 11:59 p.m. Eastern Time on April 22, 2013. You may vote in the following ways:other frequently asked questions.

|

|

|

|

Yes. You may revoke a proxy at any time before the proxy is exercised by filing with the Corporate Secretary a notice of revocation, or by submitting a later-dated proxy by mail, telephone or electronically through the Internet. You may also revoke your proxy by attending the annual meeting and voting in person.

What is householding and how does it affect me?

Exelon has adopted a procedure approved by the SEC called “householding.” Under this procedure, shareholders of record who have the same address and last name and do not participate in electronic delivery of proxy materials will receive only one copy of this Notice of Annual Meeting and Proxy Statement and the 2012 Annual Report, unless we are notified that one or more of these shareholders wishes to continue receiving individual copies. This procedure will reduce our printing costs and postage fees.

2

What are the voting requirements to elect the directors and to approve each of the proposals discussed in the Proxy Statement?

The presence of the holders of a majority of the outstanding shares of common stock entitled to vote at the annual meeting, in person or represented by proxy, is necessary to constitute a quorum.GOVERNANCE HIGHLIGHTS

ElectionExelon is committed to maintaining the highest standards of Directors: Majority Vote Policy

Undercorporate governance. Strong corporate governance practices help us achieve our Bylaws, directors must be elected by a majority of votes cast in uncontested elections. This means thatperformance goals and maintain the number of votes cast “for” a director nominee must exceed the number of votes cast “against” the nominee. In contested elections, the vote standard would be a plurality of votes cast.

Our Bylaws provide that, in an uncontested election, each director nominee must submit to the board before the annual meeting a letter of resignation that becomes effective only if the director fails to receive a majority of the votes cast at the annual meeting. The resignation of a director nominee who is not an incumbent director is automatically accepted by the board. The resignation of an incumbent director is tendered to the independent directors of the board for a determination of whether or not to accept the resignation. The board’s decisiontrust and the basis for the decision would be disclosed within 90 days following the certification of the final vote results.

Ratification of PricewaterhouseCoopers as Independent Accountant

The appointment of PricewaterhouseCoopers LLP as Exelon Corporation’s independent accountant requires an affirmative vote of a majority of shares of common stock represented at the annual meeting and entitled to vote thereon in order to be adopted.

Executive Compensation

The vote on executive compensation is advisory and is not binding on the company, the board of directors, or the compensation committee in any way, as provided by law. Our board and the compensation committee will review the results of the vote and will take it into account in making a determination concerning executive compensation consistent with our record of shareowner engagement.

Amended and Restated Employee Stock Purchase Plan

The approval of the amended and restated Employee Stock Purchase Plan requires an affirmative vote of a majority of shares represented at the annual meeting and entitled to vote thereon in order to be adopted.

How frequently will I have an opportunity to vote on executive compensation?

Every year. The Exelon board of directors has decided to hold the advisory vote on executive compensation annually until the next required vote on the frequency of shareholder votes on the compensation of executives.

Could other matters be decided at the annual meeting?

At the date this proxy statement went to press, we did not know of any matters to be raised at the annual meeting other than those referred to in this proxy statement.

Representatives of Broadridge Financial Communications and Exelon’s Office of Corporate Governance will tabulate the votes and act as inspectors of the election.

Where can I find the voting results?

We will report the voting results in a Form 8-K to be filed with the SEC within four business days following the endconfidence of our annual meeting.

Who will pay for the cost of this proxy solicitation?

Exelon will pay the cost of soliciting proxies. Proxies may be solicited on our behalf by directors, officers orinvestors, employees, in person or by telephone, electronic transmission and facsimile transmission. We have hired Alliance Advisors, LLC to distribute and solicit proxies. We will pay Alliance Advisors, LLC a fee of $10,000 plus reasonable expenses for these services.

3

Communication with the Board of Directors

Process for Shareholder Communications with the Board

Shareholderscustomers, regulatory agencies and other interested persons can communicate with the Lead Director or with the independent directors as a group by writing to them, c/o Bruce G. Wilson, Senior Vice President, Deputy General Counsel and Corporate Secretary, Exelon Corporation, 10 South Dearborn Street, P.O. Box 805398, Chicago, Illinois 60680-5398. The board has instructed the Corporate Secretary to review communications initially and transmit a summary to the directors and to exclude from transmittal any communications that are commercial advertisements, other forms of solicitation, general shareholder service matters or individual service or billing complaints. Under the board policy, the Corporate Secretary will forward to the directors any communication raising substantial issues. All communications are available to the directors upon request. Shareholders may also report an ethics concern with the Exelon Ethics Hotline by calling 1-800-23-Ethic (1-800-233-8442). You may also report an ethics concern via the Internet at EthicsOffice@ExelonCorp.com.

If you want to submit a proposal for possible inclusion in next year’s proxy statement, you must submit it in writing to the Corporate Secretary, Exelon Corporation, 10 South Dearborn Street, P.O. Box 805398, Chicago, Illinois 60680-5398. Exelon must receive your proposal on or before October 25, 2013. Exelon will consider only proposals meeting the requirements of the applicable rules of the Securities and Exchange Commission (“SEC”). Under our Bylaws, the proposal must also disclose fully all ownership interests the proponent has in Exelon and contain a representation as to whether the shareholder has any intention of delivering a proxy statement to the other shareholders of Exelon.

We strongly encourage any shareholder interested in submitting a proposal to contact our Corporate Secretary in advance of this deadline to discuss the proposal, and shareholders may want to consult knowledgeable counsel with regard to the detailed requirements of applicable securities laws. Submitting a shareholder proposal does not guarantee that we will include it in our proxy statement.stakeholders. Our corporate governance committee reviews all shareholder proposalspractices are described in more detail onpages 9-27 and makes recommendations to the board for action on such proposals.

Additionally, underin our Bylaws, for a shareholder to bring any matter before the 2014 annual meeting that is not included in the 2014 proxy statement, the shareholder’s written notice must be received by the Corporate Secretary not less than 120 days prior to the first anniversary of the 2013 annual meeting, which will be December 24, 2013. Exelon’s offices will be closed December 24 and 25, 2013 and therefore the deadline will be extended until December 26, 2013.

A shareholder who wishes to recommend a candidate (including a self-nomination) to be considered by the Exelon corporate governance committee for nomination as a director must submit the recommendation in writing to the Chair of the Corporate Governance Committee, c/o Bruce G. Wilson, Senior Vice President, Deputy General Counsel and Corporate Secretary, Exelon Corporation, 10 South Dearborn Street, P.O. Box 805398, Chicago, Illinois 60680-5398. The corporate governance committee will consider all recommended candidates and self-nominees when making its recommendation to the full board of directors to nominate a slate of directors for election.

|

|

4

Availability of Corporate Documents

The Exelon Corporate Governance Principles the Exelon Code of Business Conduct, the Exelon Amended and Restated Bylaws, and the charters for the audit, corporate governance, compensation and other committees of the board of directorswhich are available on the Exelon website atwww.exeloncorp.com on the corporate governance page under the Investors tab. Copies may be printed

Director Independence | • 11 of our 13 nominees are independent. • Our CEO is the only management director. • During 2014, all of our board committees (except the generation oversight committee and investment oversight committee) were composed exclusively of independent directors. | |

Board Leadership | • We have an independent Lead Director, selected by the independent directors. • The Lead Director serves as non-exclusive liaison between management and the other non-management directors. • The positions of Chairman and CEO are separated | |

Executive Sessions | • The independent directors regularly meet in executive sessions without management, at which the Lead Director presides. | |

Board Oversight of Risk Management | • Our board reviews Exelon’s systematic approach to identifying and assessing risks faced by Exelon and our business units. • The board considers enterprise risk in connection with emerging trends or developments and the evaluation of capital investments and business opportunities. • The board’s finance and risk committee oversees our risk management strategy, policies and practices and financial condition and risk exposures. | |

Stock Ownership Requirements | • Our independent directors must hold at least 15,000 shares of Exelon common stock within five years after joining the board. • Our CEO must, after five years of employment, hold Exelon Common Stock valued at six times base salary. • Executive vice presidents and higher officers must, within five years after employment or September 30, 2012, hold Exelon Common Stock, valued at three times base salary. | |

Board Practices | • Our board annually reviews its effectiveness as a group. • Continuing director education is provided during regular board and committee meetings. • Directors may not stand for election after age 75. | |

Accountability | • All directors stand for election annually. • In uncontested elections, directors must be elected by a majority of votes cast. | |

| iv | Exelon CorporationNotice of the Annual Meeting and 2015 Proxy Statement |

Proxy Statement Summary

2014 EXECUTIVE COMPENSATION HIGHLIGHTS

1 STRONG COMPANY PERFORMANCE

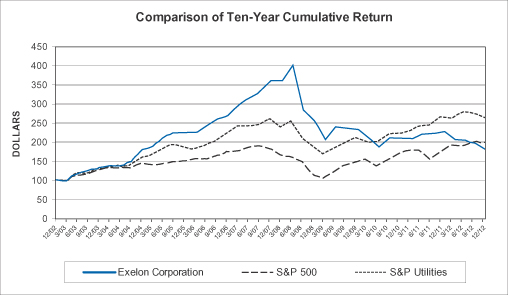

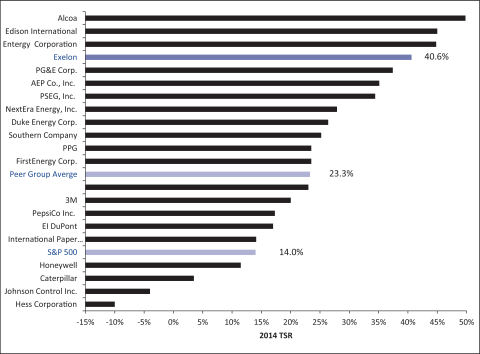

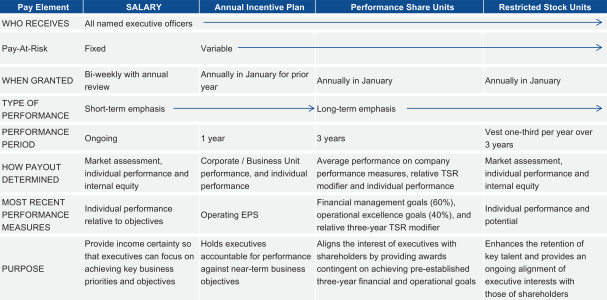

| • | Exelon’s share price was up 35.4% for the year, with a total shareholder return of 40.6% (including reinvested dividends), outpacing the S&P 500 (14.0%) and our 20 company peer group (23.3%). |

| • | Exelon Utilities completed the year with high performance across key operating areas including safety (top decile) and top quartile performance in all three utilities (BGE, ComEd and PECO) for both outage frequency and duration. See chart on page 53 for full details. |

| • | Exelon Generation had exceptional plant performance in 2014, including nuclear capacity factor of over 94%, power dispatch match of nearly 97%, and renewables (wind and solar) energy capture of 95%. |

2 STRONG EXECUTION OF M&A STRATEGY

| • | Executed a merger agreement to acquire Pepco Holdings Inc. (PHI) for $6.8 billion, with an anticipated closing in the second or third quarter of 2015. |

| • | Divested five non-core power plants to yield $1.8 billion of pre-tax proceeds ($1.4 billion after-tax). |

| • | Acquired two Midwest energy marketers (ProLiance and Integrys), virtually doubling the number of customers by adding over 1.2 million residential and commercial and industrial customers. |

| • | Invested in a portfolio of Bloom Energy fuel cell products to further the Bloom partnership and advance Exelon’s objectives in building its distributed generation business. |

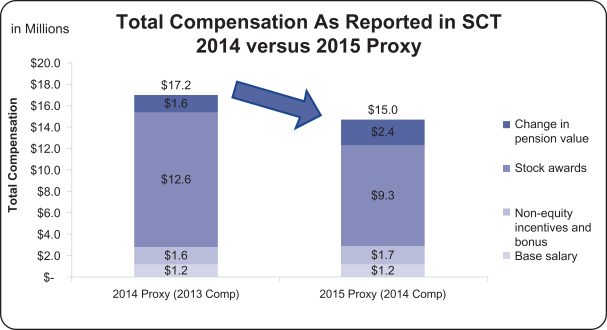

3 DECREASE IN CEO REPORTED COMPENSATION

| • | As reported in the summary compensation table on page 60, CEO pay decreased 13%, or 20% excluding the change in pension value and deferred compensation earnings. This decrease was attributed to the one-time, performance-based transition award. For more details refer to the transition award section on page 53. |

| • | For 2014, CEO target total direct compensation was calibrated to approximate the market median of the 20 company peer group. For additional information, please see CEO pay-at-glance section on pages 39-41. |

4 COMMITMENT TO SHAREHOLDER ENGAGEMENT

| • | The company met with investors holding approximately 46% of the outstanding shares (up from about 35% the prior year). |

| • | No material plan design changes made for 2014, as shareholders expressed support for the design changes that we implemented in 2013. See page 41 for details. |

| • | For 2015, the company is making a few enhancements based on shareholder feedback received during the fall 2014 outreach, including increasing the CEO’s stock ownership target from 5X to 6X to align more closely with market practice. |

5 STRONG INCENTIVE GOAL RIGOR

| • | The 2014 performance share goals, which are part of the LTI Program, were set at a level that resulted in eight of the ten underlying metrics being more challenging than the prior year, aligning with top quartile and top decile industry performance standards as shown on page 53. |

| Exelon CorporationNotice of the Annual Meeting and 2015 Proxy Statement | v |

[THIS PAGE INTENTIONALLY LEFT BLANK]

| vi | Exelon CorporationNotice of the Annual Meeting and 2015 Proxy Statement |

| Exelon CorporationNotice of the Annual Meeting and 2015 Proxy Statement | vii |

Cautionary Statements Regarding Forward-Looking Information

This proxy statement contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, that are subject to risks and uncertainties. The factors that could cause actual results to differ materially from the Exelon website and copies are available without charge to any shareholder who requests themforward-looking statements made by writing to Bruce G. Wilson, Senior Vice President, Deputy General Counsel and Corporate Secretary, Exelon Corporation 10 South Dearborn Street, P.O. Box 805398, Chicago, Illinois 60680-5398. In addition, our Articlesinclude those factors discussed herein, as well as the items discussed in (1) Exelon’s 2014 Annual Report on Form 10-K in (a) ITEM 1A. Risk Factors, (b) ITEM 7. Management’s Discussion and Analysis of Incorporation, Compensation Consultant Independence Policy, Political Contributions Guidelines, biographical information concerning each director,Financial Condition and allResults of ourOperations and (c) ITEM 8. Financial Statements and Supplementary Data: Note 22 and (2) other factors discussed in filings submitted towith the SEC by Exelon. Readers are availablecautioned not to place undue reliance on our website. Access to this information is freethese forward-looking statements, which apply only as of charge to any user with internet access. Information contained on our website is not partthe date of this proxy statement. Exelon does not undertake any obligation to publicly release any revision to its forward-looking statements to reflect events or circumstances after the date of this proxy statement.

| viii | Exelon CorporationNotice of the Annual Meeting and 2015 Proxy Statement |

Election of Directors

PROPOSAL 1: ELECTION OF DIRECTORS

DIRECTOR NOMINEES

Upon the recommendation of the corporate governance committee, the board nominated the 13 candidates named below for election as directors, each to serve a term ending with the annual meeting in 2016. Each of the nominees has agreed to be named in this proxy statement and to serve as a director, if elected. If any director is unable to stand for election, the board may reduce the number of directors or designate a substitute. In that case, shares represented by proxies may be voted for a substitute director. Exelon does not expect that any director nominee will be unable to serve.

The corporate governance committee believes that the current membership of the board represents an effective mix of directors in terms of the range of backgrounds and experience and diversity. The current board consists of directors who range in age from 56 to 74, with an average age of 64.2 and a median age of 67. The tenure of the directors is similarly varied, with one director having served since the company’s creation in 2000, one since 2002, one since 2005, two since 2007, one since 2008, one since 2009, five since 2012 and one joining in 2013. Four directors come from the Chicago area, one from the Philadelphia area, while eight come from other parts of the country including major metropolitan areas such as New York and Washington, D.C.

The current directors have a wide diversity of experiences that fill the needs of the board and its committees. Eight directors are current or former CEOs of corporations; one is the former CEO of a university. Two directors have strong nuclear experience. Six directors have experience in banking and investment management. One has served in government and one has flag officer military experience. Individual directors have experience or expertise in accounting, utility regulation and operations, and environmental matters, law, the economics of energy and government affairs.

The board of directors held eight meetings during 2014. The board also attended a two-day strategy retreat with the senior officers of Exelon and subsidiary companies. All directors attended at least 75% of all board and committee meetings that they were eligible to attend, with an average attendance of approximately 98.36% across all directors for all board and committee meetings. Although Exelon does not have a formal policy requiring attendance at the annual shareholders meeting, all directors generally attend the annual meeting. Ms. Sue Gin who served as a director since 2000 passed away on September 26, 2014. Hon. Nelson Diaz, who served as a director since 2004, declined to stand for re-election to the board.

The board of directors unanimously recommends a vote “FOR” each of the director nominees below.

| Exelon CorporationNotice of the Annual Meeting and 2015 Proxy Statement | 1 |

Election of Directors

| ANTHONY K. ANDERSON | In 2012, Mr. Anderson retired as the Vice Chair and Midwest Area Managing Partner of Ernst & Young, after a 35-year career with E&Y. In that capacity, Mr. Anderson oversaw a practice of 3,500 audit, tax, and transaction professionals serving clients through the Midwest. Mr. Anderson also served for six years in the Los Angeles area as managing partner of E&Y’s Pacific Southwest region. Mr. Anderson also served as a member of Ernst & Young’s governing body, the Americas Executive Board. Mr. Anderson currently serves on the boards of AAR Corp. (aerospace and defense), where he serves on the audit and compensation committees; Avery Dennison Corporation (labeling and packaging materials), where he serves on the audit and finance committee; and First American Financial Corporation (financial services), where he serves on the governance and nominating committee. Mr. Anderson also served as a director of the Federal Reserve Bank of Chicago from 2008-2010. Mr. Anderson is the chairman of the board of the Perspectives Charter School. He is also a member of the boards of Chicago Urban League, The Chicago Council on Global Affairs, the Regional Transportation Authority and World Business Chicago. In Los Angeles, Mr. Anderson served as chairman of Town Hall Los Angeles, the Children’s Bureau of Southern California, and the California Science Center. Mr. Anderson is a member of the American, California, and Illinois Institute of Certified Public Accountants. Mr. Anderson’s experience as the vice chair of a global professional services firm and his training and experience as an audit partner and certified public accountant enhance his contribution to the Exelon board and add value to his experience on the audit, finance and risk and generation oversight committees. | |||

| ||||

Retired Vice Chair and Midwest Area Managing Partner of Ernst & Young | ||||

Age:59 Director since:2013 | ||||

Committees: Chair-Audit Committee Member-Finance and Risk Committee Member-Generation Oversight Committee | ||||

| ANN C. BERZIN | Ms. Berzin has been a director of Exelon since March 12, 2012. Previously, Ms. Berzin served as a director of Constellation Energy Group from 2008 through March 2012 when Constellation merged with Exelon. From 1992 to 2001, Ms. Berzin served as Chairman and Chief Executive Officer of Financial Guaranty Insurance Company (FGIC), an insurer of municipal bonds, asset-backed securities and structured finance obligations. Ms. Berzin joined FGIC in 1985 as its General Counsel following seven years of securities law practice in New York City. Ms Berzin is a director of Ingersoll-Rand plc, Chair of its finance committee, and a member of its audit committee, and previously served as a director of Kindred Healthcare, Inc. (healthcare services) from 2006-2012. Ms. Berzin has broad business and executive leadership experience, as well as expertise in the financial services sector, which is particularly valuable in the area of risk management. Ms. Berzin also serves on the board of Baltimore Gas and Electric Company (“BGE”), an Exelon subsidiary. | |||

| ||||

Former Chairman and Chief Executive Officer of Financial Guaranty Insurance Company (FGIC) | ||||

Age:62 Director since:2012 | ||||

Committees: Member-Audit Committee Member-Finance and Risk Committee | ||||

| 2 | Exelon CorporationNotice of the Annual Meeting and 2015 Proxy Statement |

Election of Directors

| JOHN A. CANNING, JR. | Mr. Canning is the Chairman and co-founder of Madison Dearborn Partners, LLC (“MDP”), which specializes in management buyout and growth equity investing. MDP has raised investment funds with more than $18 billion in limited partner commitments from over 400 endowments, pension funds and other sophisticated investors. MDP has made significant investments in the energy and power industry. Prior to co-founding Madison Dearborn Partners, Mr. Canning spent 24 years with First Chicago Corporation, where he managed the bank’s venture investments. Mr. Canning has over 34 years of experience in private equity investing, including reviewing financial statements and audit results and making investment and acquisition decisions. Mr. Canning is a former director and Chairman of the Federal Reserve Bank of Chicago, giving him insight into economic trends important to the business of Exelon. Mr. Canning also serves on the board of Corning, Inc., a specialty glass and ceramics producer. Mr. Canning has also served on the board of directors of Jefferson Smurfit Group plc and on the audit committees of several charitable organizations, including the Irish Pension Reserve Fund. In addition to his business experience, he also has a law degree. Mr. Canning is a recognized leader in the Chicago business community with knowledge of the economy of the Midwestern United States and the northern Illinois communities that Exelon serves. Mr. Canning’s business experience and service on the boards of other companies and organizations enable him to contribute to the work of the Exelon board. Mr. Canning’s experience in banking and in managing investments, and his experience on the audit committees of other organizations, make him a valued member of the compensation and leadership development committee and the corporate governance committee. | |||

| ||||

Chairman and co-founder of Madison Dearborn Partners, LLC | ||||

Age:70 Director since:2008 | ||||

Committees: Chair-Compensation and Leadership Development Committee Member-Corporate Governance Committee | ||||

| CHRISTOPHER M. CRANE | Mr. Crane is President and Chief Executive Officer of Exelon Corporation since March 12, 2012. Previously, he served as President and Chief Operating Officer, Exelon; President and Chief Operating Officer, Exelon Generation since 2008. In that role, he oversaw one of the U.S. industry’s largest portfolios of electric generating capacity, with a multi-regional reach and the nation’s largest fleet of nuclear power plants. He directed a broad range of business including major acquisitions, transmission strategy, cost management initiatives, oversight of major capital programs, generation asset optimization and generation development. Mr. Crane is one of the leading executives in the electric utility and power industries. Mr. Crane served as a director of Aleris International Inc. from 2010 through October 2013 (manufacture and sale of aluminum rolled and extruded products), where he served on the compensation committee and as the chair of the nominating and corporate governance committee. He is a member of the executive committee of the Edison Electric Institute and the board of directors of the Institute of Nuclear Power Operations, the industry organization promoting the highest levels of safety and reliability in nuclear plant operation. He is vice chairman of the Nuclear Energy Institute, the nation’s nuclear industry trade association, where he has also served as chairman of the New Plant Oversight Committee and as a member of the Nuclear Strategic Issues Advisory Committee, the Nuclear Fuel Supply Committee and the Materials Initiative Group. Mr. Crane also serves as chair of the boards of directors of Exelon subsidiaries BGE, Commonwealth Edison Company (“ComEd”) and PECO Energy Company (“PECO”). | |||

| ||||

President and Chief Executive Officer of Exelon Corporation | ||||

Age:56 Director since:2012 | ||||

Committees: Member-Generation Oversight Committee Member-Investment Oversight Committee | ||||

| Exelon CorporationNotice of the Annual Meeting and 2015 Proxy Statement | 3 |

Election of Directors

| YVES C. DE BALMANN | Mr. de Balmann has been a director of Exelon since March 12, 2012. Mr. de Balmann served as a director of Constellation Energy Group from 2003 through March 2012 when Constellation merged with Exelon. Mr. de Balmann served as the Co-Chairman of Bregal Investments LP, a private equity investing firm, from September 2002 through December 2012. He was Vice-Chairman of Bankers Trust Corporation, in charge of Global Investment Banking, until its merger with Deutsche Bank in 1999 when he became Co-Head of Deutsche Bank’s Global Investment Bank, and Co-Chairman and Co-Chief Executive Officer of Deutsche Banc Alex. Brown from June 1999 to April 2001, and then a Senior Advisor to Deutsche Bank AG from April 2001 to June 2003. Mr. de Balmann served as a director of Laureate Education, Inc. through December 2014; and he is non-executive Chairman of Conversant Intellectual Property Management. Mr. de Balmann has extensive experience in corporate finance, including the derivatives and capital markets. | |||

| ||||

Former Co-Chairman of Bregal Investments LP | ||||

Age:68 Director since:2012 | ||||

Committees: Member-Audit Committee Member-Compensation and Leadership Development Committee Member-Finance and Risk Committee | ||||

| NICHOLAS DEBENEDICTIS | Mr. DeBenedictis is the Chairman (since 1993), President and Chief Executive Officer (since 1992) of Aqua America Inc., a water utility with operations in 10 states. Aqua America is the second largest U.S.-based, publicly-traded water and wastewater company in the country. As CEO, Mr. DeBenedictis has experience in dealing with many of the same development, land use and utility regulatory issues that affect Exelon and its subsidiaries. Mr. DeBenedictis also has extensive experience in environmental regulation and economic development, having served in two cabinet positions in the Pennsylvania government, as Secretary of the Pennsylvania Department of Environmental Resources and as Director of the Office of Economic Development. He also spent eight years with the U.S. Environmental Protection Agency and was President of the Greater Philadelphia Chamber of Commerce for three years. Mr. DeBenedictis has also served as a director of P.H. Glatfelter, Inc. (global supplier of specialty papers and engineered products) since 1995, where he has served on the audit, compensation and finance, and nominating and corporate governance committees and currently serves as the chair of the finance committee and on the compensation committee. Mr. DeBenedictis served as a director of Met-Pro Corporation (global provider of solutions and products for product recovery, pollution control, and fluid handling applications) (1997-February 2010). While a director of Met-Pro, he served as presiding independent director, chair of the corporate governance and nominating committee and a member of the audit committee. Mr. DeBenedictis has a master’s degree in environmental engineering and science. As a leader in the greater Philadelphia business community, he has knowledge of the communities and local economies served by PECO. Mr. DeBenedictis’ contribution to the Exelon board is enhanced by his experience as the CEO of a public company, his experience on the boards of other companies, his experience as a utility executive, and his experience with environmental regulation, all of which bring useful perspectives to the Exelon board’s finance and risk committee and the generation oversight committee. His prior experience as the presiding director and chair of the corporate governance committee of another public company offers additional insight to the functions of the Exelon corporate governance committee. Mr. DeBenedictis also serves on the boards of ComEd and PECO, which are Exelon subsidiaries. | |||

| ||||

Chairman, President and Chief Executive Officer of Aqua America Inc. | ||||

Age:69 Director since:2002 | ||||

Committees: Member-Corporate Governance Committee Member-Finance and Risk Committee Member-Generation Oversight Committee | ||||

| 4 | Exelon CorporationNotice of the Annual Meeting and 2015 Proxy Statement |

Election of Directors

| PAUL L. JOSKOW, PH. D. | Dr. Joskow has been the President of the Alfred P. Sloan Foundation since January 1, 2008. The Sloan Foundation is a philanthropic institution that supports research and education in science, technology and economic performance. He is also the Elizabeth and James Killian Professor of Economics and Management Emeritus at the Massachusetts Institute of Technology (MIT). Dr. Joskow joined the MIT faculty in 1972 and served as head of the MIT Department of Economics (1994-1998) and Director of the MIT Center for Energy and Environmental Policy Research (1999-2007). At MIT he was engaged in teaching and research in the areas of industrial organization, energy and environmental economics, competition policy, and government regulation of industry for over 35 years. Much of his research and consulting activity has focused on the electric power industry, electricity pricing, fuel supply, demand, generating technology, and regulation. He is a Fellow of the American Academy of Arts and Sciences, the Econometric Society and a Distinguished Fellow of the American Economic Association. He has served on the U.S. Environmental Protection Agency’s (“EPA”) Acid Rain Advisory Committee, on the Environmental Economics Committee of EPA’s Science Advisory Board, and on the National Commission on Energy Policy. He presently serves on the Secretary of Energy Advisory Board. He served as the Chair of the National Academies Board of Science, Technology and Economic Policy through March 1, 2015. He is also a Trustee of the Putnam Mutual Funds. In addition to his teaching, research, publishing and consulting activities, he has experience in the energy business, serving as a director of New England Electric System, a public utility holding company (1987-2000), until it was acquired by National Grid. He then served as a director of National Grid plc, an international electric and gas utility holding company, and one of the largest investor-owned utilities in the world (2000-2007). Dr. Joskow served as a director of TransCanada Corporation from 2004 until March 2013. TransCanada is an energy infrastructure company with gas pipelines, oil pipelines, electric power operations, and natural gas storage facilities. He served on the audit and governance committees of TransCanada. He previously served on the audit committee of National Grid (2000-2005) and was chair of its finance committee until 2007. He also served on the audit committee of New England Electric System and as the chair of the audit committee of the Putnam Mutual Funds (2002-2005). | |||

| ||||

President of the Alfred P. Sloan Foundation | ||||

Age:67 Director since:2007 | ||||

Committees: Member-Audit Committee Member-Finance and Risk Committee Member-Investment Oversight Committee | ||||

| ROBERT J. LAWLESS | Mr. Robert J. Lawless has been a director of Exelon since March 12, 2012. Mr. Lawless served as a director of Constellation Energy Group from 2002 through March 2012 when Constellation merged with Exelon. Mr. Lawless served as Chairman of the Board of McCormick & Company, Inc. (food manufacturing industry) from January 1997 until March 2009, having also served as President until December 2006 and Chief Executive Officer until January 2008, and is now retired. He is also a director of The Baltimore Life Insurance Company. Mr. Lawless has extensive executive leadership and strategic planning experience. As a former chief executive officer of a public company, he can provide a critical perspective on issues affecting public companies. Mr. Lawless serves on the compensation and leadership development committee and as the chair of the corporate governance committee. | |||

| ||||

Former Chairman of the Board | ||||

Age:68 Director since:2012 | ||||

Committees: Chair-Corporate Governance Member-Compensation and | ||||

| Exelon CorporationNotice of the Annual Meeting and 2015 Proxy Statement | 5 |

Election of Directors

| RICHARD W. MIES | Admiral Mies is President and Chief Executive Officer of The Mies Group, Ltd, a private consulting firm that provides strategic planning and risk assessment advice and assistance to clients on international security, energy, defense, and maritime issues. A distinguished graduate of the Naval Academy, he completed a 35-year career as a nuclear submariner in the US Navy. Admiral Mies has a wide range of operational command experience; he served as the senior operational commander of the US Submarine Force and he commanded U.S. Strategic Command for four years prior to retirement in 2002. He subsequently served as a Senior Vice President of Science Applications International Corporation, a provider of scientific and engineering applications for national security, energy, and environment, and as the President and Chief Executive Officer of Hicks and Associates, Inc, a subsidiary of SAIC from 2002-2007. Admiral Mies served as a director of Mutual of Omaha, an insurance and banking company, from 2002-2014, where he chaired the governance committee and served as a member of the audit, compensation, investment, and executive committees. From 2008–2010 Admiral Mies was a director of McDermott International, an engineering and construction company focused on energy infrastructure, where he served on the audit and governance committees. In 2010 he transitioned to the board of Babcock and Wilcox (“B&W”) when that company spun off from McDermott International. He is chair of B&W’s safety and security committee and a member of the governance committee. He is also a member of the Boards of Governors of Los Alamos and Lawrence Livermore National Security LLCs that operate their respective national laboratories. In addition to an undergraduate degree in mechanical engineering and mathematics, Admiral Mies completed post-graduate education at Oxford University, the Fletcher School of Law and Diplomacy, and Harvard University and holds a Masters degree in government administration and international relations. Admiral Mies makes a unique contribution to Exelon’s generation oversight, finance and risk, and audit committees through his extensive leadership experience with nuclear power and strategic planning in the Navy and in business and through his experience on the boards of other companies. | |||

| ||||

President and Chief Executive | ||||

Age:70 Director since:2009 | ||||

Committees: Chair-Generation Oversight Member-Audit Committee Member-Corporate Governance Member-Finance & Risk | ||||

| WILLIAM C. RICHARDSON, PH. D. | Dr. Richardson serves as lead director. Dr. Richardson is the President and Chief Executive Officer Emeritus of the W.K. Kellogg Foundation, a private foundation, and the President and Chief Executive Officer Emeritus of Johns Hopkins University. Dr. Richardson served as the President and CEO of the W. K. Kellogg Foundation until his retirement (1995-2005). He also served as chairman of the Kellogg Trust (1996-2007). In that position he and two other trustees directly oversaw the management of an approximately $7.7 billion fund, including a significant position in Kellogg Company (cereal and convenience foods). He was the President of Johns Hopkins University (1990-1995), and Executive Vice President and Provost of Pennsylvania State University (1984-1990). He is a member of the Institute of Medicine, National Academy of Sciences. Dr. Richardson has served as a director of The Bank of New York Mellon Corporation since 1998; of CSX Corporation (railroad) (1992-2008); and of Kellogg Company (1996-2007). Dr. Richardson serves on the audit and corporate governance and nominating committees of Bank of New York Mellon Corporation, and previously served on the audit, governance, and compensation committees of CSX. He was chair of the governance and compensation committees and lead director of CSX, and chair of the finance committee of Kellogg. Dr. Richardson has an MBA and PhD. from the University of Chicago Graduate School of Business. Dr. Richardson’s experience as CEO of a large international research university and in leading a large investment fund and serving as a director of three major corporations and as a member of their governance, audit, risk and compensation committees make him qualified to serve as a director of Exelon. Through his experience, including experience on the committees of other organizations, Dr. Richardson contributes to the work of the Exelon audit, compensation and leadership development and corporate governance committees. | |||

| ||||

President and Chief Executive Officer Emeritus of the W.K. Kellogg Foundation | ||||

Age:74 Director since:2005 | ||||

Committees: Lead Director Member-Audit Committee Member-Compensation and Member-Corporate Governance Member-Investment Oversight | ||||

| 6 | Exelon CorporationNotice of the Annual Meeting and 2015 Proxy Statement |

Election of Directors

| JOHN W. ROGERS, JR. | Mr. Rogers is the founder, Chairman and CEO of Ariel Investments, LLC, an institutional money management firm with over $9 billion in assets under management, and serves as trustee of the Ariel Investment Trust. Since 2003, he has served as a director of McDonald’s Corporation (global foodservice retailer) where he has served on the compensation, finance and corporate responsibility committees. Previously, he served as a director of Aon Corporation (risk management services, insurance and reinsurance brokerage and human capital and management consulting services) (1993-2012), where he served on the finance committee and as chair of the audit committee; GATX corporation (rail, marine and industrial equipment leasing) (1998-2004), where he served on the audit committee; Bank One Corporation (bank) (1998-2004), where he served on the audit and risk management and public responsibility committees; and Bally Total Fitness (fitness and health clubs) (2003-2006), where he served as the lead independent director and as chair of the compensation committee. Mr. Rogers’ experience on the boards of a number of major corporations based in Chicago in a variety of industries has made him a leader in the Chicago business community with perspective into Chicago business developments. His role in Chicago’s and the nation’s African-American community brings diversity to the board and emphasis to Exelon’s diversity initiatives and community outreach. His experience in investment management and financial markets and as a director of an insurance brokerage and services company are useful to Exelon, particularly with respect to risk management and the management of Exelon’s extensive nuclear decommissioning and pension and post-retirement benefit trust funds, which are overseen by the investment oversight committee, which he chairs. Mr. Rogers’ service on the boards and committees of other companies has given him experience that adds further depth to the Exelon corporate governance committee. He has spoken at and participated in a number of corporate governance conferences. He was named by the Outstanding Directors Exchange as one of six 2010 Outstanding Directors. | |||

| ||||

Chairman and CEO of Ariel Investments, LLC | ||||

Age:56 Director since:2000 | ||||

Committees: Chair-Investment Oversight Committee Member-Corporate Governance Committee | ||||

| MAYO A. SHATTUCK III | Mr. Shattuck is Chairman of the Board of Exelon Corporation. Previously, Mr. Shattuck served as the Executive Chairman from March 2012 to February 2013. Prior to joining Exelon, Mr. Shattuck was the Chairman, President and Chief Executive Officer of Constellation Energy, a position he held from 2001 to March 2012. Mr. Shattuck was previously at Deutsche Bank, where he served as Chairman of the Board of Deutsche Bank Alex. Brown and, during his tenure, served as Global Head of Investment Banking and Global Head of Private Banking. From 1997 to 1999, he served as Vice Chairman of Bankers Trust Corporation, which merged with Deutsche Bank in June 1999. From 1991 until 1997, Mr. Shattuck was President and Chief Operating Officer and a Director of Alex. Brown Inc., which merged with Bankers Trust in September 1997. Mr. Shattuck is the past Chairman of the Board of the Institute of Nuclear Power Operations and was previously a member of the executive committee of the board of Edison Electric Institute. He was also Co-Chairman of the Center for Strategic & International Studies Commission on Nuclear Policy in the United States. He currently serves on the board of directors of Gap Inc. and is chairman of its audit and finance committee. He also serves as a director of Capital One Financial Corporation, where he is chairman of its compensation committee. Mr. Shattuck’s qualifications to serve as director include his extensive experience in business and the energy industry in particular, gained from his service as Constellation Energy’s Chief Executive Officer, which enables him to effectively identify strategic priorities and execute strategy. His financial expertise gained from his years of experience in the financial services industry also brings a valuable perspective to the board. | |||

| ||||

Former Chairman, President | ||||

Age:60 Director since:2012 | ||||

Committees: Member-Generation Oversight Member-Investment Oversight | ||||

| Exelon CorporationNotice of the Annual Meeting and 2015 Proxy Statement | 7 |

Election of Directors

| STEPHEN D. STEINOUR | In January 2009, Mr. Steinour was elected the Chairman, President and Chief Executive Officer of Huntington Bancshares Incorporated, a $64 billion regional bank holding company. Previously, he was the Chairman and Managing Partner of CrossHarbor Capital Partners, a private equity firm (2008-January 2009). From 2006 to 2008, he was President and CEO of Citizens Financial Group, Inc., a multistate commercial bank holding company. Prior to that, Mr. Steinour served as Vice Chairman and Chief Executive Officer of Citizens Mid-States regional banking (2005-2006). He served as Vice Chairman and Chief Executive Officer of Citizens Mid-Atlantic Region (2001-2005). At the beginning of his career, Mr. Steinour was an analyst for the U.S. Treasury Department and subsequently worked for the Federal Deposit Insurance Corporation. Mr. Steinour was a member of the board of trustees of the Liberty Property Trust (an office and industrial property real estate investment trust) from February 2010 until May 2014, where he served on its audit and compensation committees. Mr. Steinour was elected to the board of directors of L Brands (fashion retailer) in January 2014. He was elected to The Ohio State University Wexner Medical Center Board in November of 2013. Mr. Steinour is a member of council of The Pennsylvania Society, a non-profit, charitable organization which celebrates service to the Commonwealth of Pennsylvania. He also serves as a trustee of the Eisenhower Fellowships and is a member of the Columbus Partnership and a Trustee of the Columbus Downtown Development Corporation. He is a member of the American Bankers Association. Mr. Steinour also served as a member on the policy and legal affairs committees of the Pennsylvania Business Roundtable, an association of CEOs in large Pennsylvania companies representing significant employment and economic activity in the Commonwealth. He also has served on the board of and as the chairman of the Greater Philadelphia Chamber of Commerce. His experience at Citizens Bank gave him knowledge of the markets that Exelon Generation and PECO serve. His experience as a banker, with strong credit and risk management experience and knowledge of credit and capital markets, and his experience as Chairman and CEO of Huntington Bancshares enhances Mr. Steinour’s value to the Exelon board and to the finance and risk and audit committees. | |||

| ||||

Chairman, President and Chief | ||||

Age:56 Director since:2007 | ||||

Committees: Chair-Finance & Risk Committee Member-Audit Member-Compensation and | ||||

| 8 | Exelon CorporationNotice of the Annual Meeting and 2015 Proxy Statement |

Election of Directors

DIRECTOR INDEPENDENCE

Under Exelon’s Corporate Governance Principles, a substantial majority of the board must be composed of independent directors, as defined by the NYSE. In addition to complying with the NYSE rules, Exelon monitors the independence of audit and compensation and leadership development committee members under rules of the SEC (for members of the audit committee and compensation and leadership development committee) and the Internal Revenue Service (for members of the compensation and leadership development committee). The board has adopted independence criteria corresponding to the NYSE rules for director independence and the following categorical standards to address those relationships that are not specifically covered by the NYSE rules:

| 1. | A director’s relationship with another company with which Exelon does business will not be considered a material relationship that would impair the director’s independence if the aggregate of payments made by Exelon to that other company, or received by Exelon from that other company, in the most recent fiscal year, is less than the greater of $1 million or 5% of the recipient’s consolidated gross revenues in that year. In making this determination, a commercial transaction will not be deemed to affect a director’s independence, if and to the extent that: (a) the transaction involves rates or charges that are determined by competitive bidding, set with reference to prevailing market prices set by a well-established commodity market, or fixed in conformity with law or governmental authority; or (b) the provider of goods or services in the transaction is determined by the purchaser to be the only practical source for the purchaser to obtain the goods or services. |

| 2. | If a director is a current employee, or a director’s immediate family member is an executive officer, of a charitable or other tax-exempt organization to which Exelon has made contributions, the contributions will not be considered a material relationship that would impair the director’s independence if the aggregate of contributions made by Exelon to that organization in its most recent fiscal year is less than the greater of $1 million or 2% of that organization’s consolidated gross receipts in that year. In any other circumstance, a director’s relationship with a charity or other tax-exempt organization to which Exelon makes contributions will not be considered a material relationship that would impair the director’s independence if the aggregate of all contributions made by Exelon to that organization in its most recent fiscal year is less than the greater of $1 million or 5% of that organization’s consolidated gross receipts in that year. Transactions and relationships with charitable and other tax-exempt organizations that exceed these standards will be evaluated by the board to determine whether there is any effect on a director’s independence. |

Each year, directors are requested to provide information about their business relationships with Exelon, including other boards on which they may serve, and their charitable, civic, cultural and professional affiliations. We also gather information on significant relationships between their immediate family members and Exelon. All relationships are evaluated by Exelon’s Office of Corporate Governance for materiality. Data on transactions between Exelon and companies for which an Exelon director or an immediate family member serves as a director or executive officer are presented to the corporate governance committee, which reviews the data and makes recommendations to the full board regarding the materiality of such relationships for the purpose of assessing director independence. The same information is considered by the full board in making the final determination of independence.

Mr. Shattuck is not considered an independent director because of his employment as executive chairman of Exelon through February 2013. Mr. Crane is not considered an independent director because of his employment as president and chief executive officer of Exelon. Each of the other current Exelon directors was determined by our board of directors to be “independent” under applicable guidelines presented above. The amounts involved in the transactions between Exelon and its subsidiaries, on the one hand, and the companies with which a director or an immediate family member is associated, on the other hand, all fell below the thresholds specified by the NYSE rules and the categorical standards specified in the company’s Corporate Governance Principles. Because Exelon provides utility services through its subsidiaries BGE, ComEd, PECO and Constellation and many of its directors live in areas served by the Exelon subsidiaries, many of the directors are affiliated with businesses and charities that receive utility services from Exelon’s subsidiaries. The corporate governance committee does not review transactions pursuant to which Exelon sells gas or electricity to these businesses or charities at

| Exelon CorporationNotice of the Annual Meeting and 2015 Proxy Statement | 9 |

Election of Directors

tariffed rates. Similarly, because Exelon and its subsidiaries are active in their communities and make substantial charitable contributions, and many of Exelon’s directors live in communities served by Exelon and its subsidiaries and are active in those communities, many of Exelon’s directors are affiliated with charities that receive contributions from Exelon and its subsidiaries. None of the directors or their immediate family members is an executive officer of any charitable organizations to which Exelon or its subsidiaries contribute. All such payments to charitable organizations were immaterial under the applicable independence criteria.

We describe below various transactions and relationships considered by the board in assessing the independence of Exelon directors.

Ann C. Berzin

Ms. Berzin serves as a director of a public company that provides equipment and services to Exelon Generation. In 2014, Exelon paid that company approximately $635,000.

Nicholas DeBenedictis

Mr. DeBenedictis serves as the chairman, president and chief executive officer of a public water utility company that received approximately $600,000 from Exelon for water supplies. Exelon made these purchases under tariffed utility rates. Mr. DeBenedictis serves as a director of a not-for-profit company that received $3,900,000 from Exelon for health care coverage for Exelon employees.

Richard W. Mies

Admiral Mies serves as the director of a public company that provides services to Exelon Generation. In 2014, Exelon paid that company approximately $6,800,000.

Dr. William C. Richardson

Dr. Richardson serves as a director of a public company that provided financial services to Exelon. In 2014, Exelon paid the company approximately $4,000,000.

John W. Rogers, Jr.

Mr. Rogers serves as a director of a company that is a customer of Exelon. The company paid Exelon approximately $19,000,000 in 2014.

Stephen D. Steinour

Mr. Steinour is the chairman, president and chief executive officer of a company that provided financial services to Exelon. In 2014, Exelon paid that company approximately $734,000. For additional information, see Related Person Transactions below.

| 10 | Exelon CorporationNotice of the Annual Meeting and 2015 Proxy Statement |

Election of Directors

RELATED PERSON TRANSACTIONS

Exelon has a written policy for the review and approval or the ratification of related person transactions. Transactions covered by the policy include commercial transactions for goods and services and the purchase of electricity or gas at non-tariffed rates from Exelon or any of its subsidiaries by an entity affiliated with a director or officer of Exelon. The retail purchase of electricity or gas from BGE, ComEd or PECO at rates set by tariff, and transactions between or among Exelon or its subsidiaries are not considered. Charitable contributions approved in accordance with Exelon’s Charitable Contribution Guidelines are deemed approved or ratified under the Related Persons Transaction policy and do not require separate consideration and ratification.

As required by the policy, the board reviewed all commercial, charitable, civic and other relationships with Exelon in 2014 that were disclosed by directors and executive officers of Exelon, BGE, ComEd and PECO, and by executive officers of Exelon Generation that required separate consideration and ratification. The Office of Corporate Governance collected information about each of these transactions, including the related persons and entities involved and the dollar amounts either paid by or received by Exelon. The Office of Corporate Governance also conducted additional due diligence, where required to determine the specific circumstances of the particular transaction, including whether it was competitively bid or whether the consideration paid was based on tariffed rates.

The corporate governance committee and the board reviewed the analysis prepared by the Office of Corporate Governance, which identified those related person transactions which required ratification or approval, under the terms of the policy, or disclosure under the SEC regulations. The corporate governance committee and the board considered the facts and circumstances of each of these related person transactions, including the amounts involved, the nature of the director’s or officer’s relationship with the other party to the transaction, whether the transaction was competitively bid and whether the price was fixed or determined by a tariffed rate.

The committee recommended that the board ratify all of the transactions. On the basis of the committee’s recommendation, the board did so. Several transactions were ratified because the related person served only as a director of the affiliated company, was not an officer or employee of the affiliated company and did not have a pecuniary or material interest in the transaction. For some of these transactions, the value or cost of the transaction was very small, and the board considered the de minimis nature of the transaction as further reason for ratifying it. The board approved and ratified other transactions that were the result of a competitive bidding process, and therefore were considered fairly priced, or arms length, regardless of any relationship. The remaining transactions were approved by the board, even though the director is an executive officer of the affiliated company, because the transactions involved only retail electricity or gas purchases under tariffed rates or the price and terms were determined as a result of a competitive bidding process. Only one of the related person transactions is required to be disclosed in this proxy statement.

Huntington Bank is a lender to Exelon and its subsidiaries and participates in their credit facilities. Huntington participates in the credit facilities on the same basis as other participating banks with terms based on a competitive process with a syndicate of banks. In 2014, Exelon and its subsidiaries paid Huntington Bank approximately $734,000 in fees for credit facilities and letters of credit. Mr. Steinour, an Exelon director, is also Chairman, President and Chief Executive Officer of Huntington Bancshares, the parent of Huntington Bank.

The corporate governance committee and the Exelon board reviewed Huntington Bank’s participation in the credit facilities as related person transactions and concluded that the transactions were in the best interests of Exelon because Huntington participates in the credit facilities on terms equivalent to those of an unrelated bank. There is no indication that Mr. Steinour was involved in the negotiations of the credit facilities or had any direct or indirect material interest in the transactions or influence over them. As compared to Exelon’s and Huntington’s overall revenues, the transactions are immaterial, individually and in the aggregate.

| Exelon CorporationNotice of the Annual Meeting and 2015 Proxy Statement | 11 |

Corporate Governance at Exelon

Exelon is committed to maintaining the highest standards of corporate governance. We believe that strong corporate governance is critical to achieving our performance goals and maintaining the trust and confidence of investors, employees, customers, regulatory agencies and other stakeholders. The Corporate Governance Principles are revised from time to time to reflect emerging governance trends and to better address the particular needs of the company as they change over time. A summary of our Corporate Governance Principles is set forth below.

Corporate Governance PrinciplesCORPORATE GOVERNANCE PRINCIPLES

Our Corporate Governance Principles, together with the board committee charters, provide the framework for the effective governance of Exelon. The board of directors has adopted our Corporate Governance Principles to address matters including qualifications for directors, standards of independence for directors, election of directors, responsibilities and expectations of directors, and evaluating board, committee and individual director performance. The Corporate Governance Principles also address director orientation and training, the evaluation of the chief executive officer and succession planning. The Corporate Governance Principles are revised from time to time to reflect emerging governance trends and to better address the particular needs of the company as they change over time.

The Board’s Function and StructureTHE BOARD’S FUNCTION AND STRUCTURE

Exelon’s business, property and affairs are managed under the direction of the board of directors. The board is elected by shareholders to oversee management of the company in the long-term interest of all shareholders. All directors stand for election annually and in uncontested elections must be elected by a majority of the votes cast. The board considers the interests of other constituencies, which include customers, employees, annuitants, suppliers, the communities we serve, and the environment. The board is committed to ensuring that Exelon conducts business in accordance with the highest standards of ethics, integrity, and transparency.

Lead Director; Chairman of the BoardBOARD LEADERSHIP

Exelon’s Corporate Governance Principles establish the position of Lead Director. The Lead Director is an independent director elected by the independent directors of the Exelon board, upon the recommendation of the corporate governance committee, with responsibilities to act at any time when (1) the positions of chairman of the board and the chief executive officer are held by the same person; or (2) for other reasons the person holding the position of chairman of the board is not an independent director under the applicable director independence standards.

As specified in the Corporate Governance Principles, the role of the Lead Director includes:

presiding at executive sessions of non-management or independent directors; |

calling meetings of the independent directors; |

serving as an advisor to the chairman and the chief executive officer (“CEO”); |

functioning as the non-exclusive liaison between the non-management directors and the chairman and the CEO; |

adding items to agendas for board meetings; |

assuring the sufficiency of the time for discussion at board meetings; |

5

leading, in conjunction with the corporate governance and compensation and leadership development committees, the process for evaluating the performance of the chairman and the CEO and determining their respective compensation; |

leading on corporate governance initiatives relevant to board and committee operations; |

in the event of the death or incapacity of the chairman of the board, serving as the acting chairman of the board until such time as a chairman of the board is selected; |

| 12 | Exelon CorporationNotice of the Annual Meeting and 2015 Proxy Statement |

receiving and responding to mail addressed to the board of directors; and |

having such additional powers and responsibilities as the board of directors may from time to time assign or request. |

The Corporate Governance Principles grant the board of directors discretion to separate the roles of chairman and chief executive officer if the board determines that such a separation is in the best interests of Exelon and its shareholders. Upon the completion of the merger between Exelon and Constellation Energy Group Inc. (“Constellation”) on March 12,in 2012, (the “Merger”), the board of directors separated the positions of chairman of the board and chief executive officer. The board appointed Mayo A. Shattuck III to the position of executive chairman and Christopher M. Crane to the position of chief executive officer. Mr. Shattuck served as executive chairman from March 2012 through February 2013 and he continues to serve as non-executive chairman of the Exelon board.

The board believes that Exelon has in place effective arrangements and structures to ensure that the company maintains the highest standard of corporate governance and board independence and independent board leadership and continued accountability of the chairman and the CEO to the board. These arrangements and structures include:

|

In 2012, the board elected William C. Richardson as the independent Lead Director. Dr. Richardson has been a member of our board since 2005. Dr. Richardson’s responsibilities as Lead Director complement Mr. Shattuck’s role as chairman and Mr. Crane’s role as CEO while providing independent board leadership and the necessary checks and balances to hold the board, the chairman and the CEO accountable in their respective roles. |

The audit, compensation and leadership development, corporate governance |

A significant portion of the business of the Exelon board is reviewed or approved by the board’s committees, and the agendas of the board’s committees are driven by the independent chairs through their discussions with management. |

The board agendas, in turn, are determined in large part by the committee agendas, and discussions at board meetings are driven to a significant degree by the committee agendas and the reports the committee chairs present to the full board. |

The performance and compensation of the |

Information About the Board of Directors and Committees

The board of directors held eleven meetings during 2012. The board also attended a two-day strategy retreat with the senior officers of Exelon and subsidiary companies. All directors attended at least 75% of all board and committee meetings that they were eligible to attend, with an average attendance of 99.5% across all directors for all board and committee meetings. Although Exelon does not have a formal policy requiring attendance at the annual shareholders meeting, all directors generally attend the annual meeting and all of them did so in 2012.

The chairman and the CEO are invited guests and are welcome to attend all committee meetings, except when the independent directors meet in executive session, such as when they conduct performance evaluations or discuss the compensation of the chairman or the CEO, or both.

Upon the closing of the Merger, four directors who served on the Constellation board of directors were appointed to the Exelon board of directors. These directors were Ms. Ann Berzin and Messrs. Yves de Balmann, Robert Lawless and

6

Mayo Shattuck III. On March 12, 2012 the newly constituted Exelon board of directors made changes to the committee memberships and certain of the committee chairs. Mr. John W. Rowe and Dr. John M. Palms also retired from the Exelon board of directors on March 12, 2012.

Ms. Berzin and Messrs. de Balmann, Lawless and Shattuck were nominated and reelected to the Exelon board of directors at the Annual Meeting of Exelon’s shareholders on April 2, 2012.

On December 31, 2012, Ms. Rosemarie B. Greco and Mr. M. Water D’Alessio retired from the Exelon board. On January 29, 2013, the Exelon board appointed Mr. Anthony K. Anderson to the Exelon board. Also, Mr. Don Thompson announced that he would not stand for reelection as a director at the 2013 Annual Meeting.

In 2012, seven standing committees assisted the board in carrying out its duties: the audit committee, the compensation committee, the corporate governance committee, the energy delivery oversight committee, the generation oversight committee, the investment oversight committee, and the risk oversight committee. The committees, their membership during 2012 and their principal responsibilities are described below:

| ||||||||||||

| ||||||||||||

| ||||||||||||

| ||||||||||||

| ||||||||||||

| ||||||||||||

| ||||||||||||

| ||||||||||||

| ||||||||||||

| ||||||||||||

| ||||||||||||

Notes to Committee Membership Table:

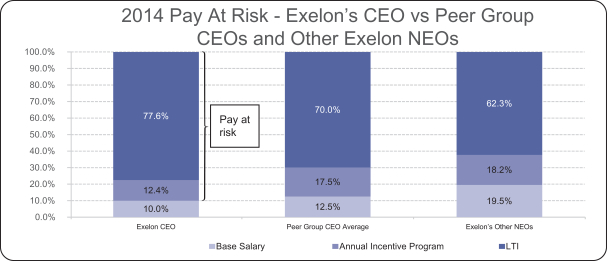

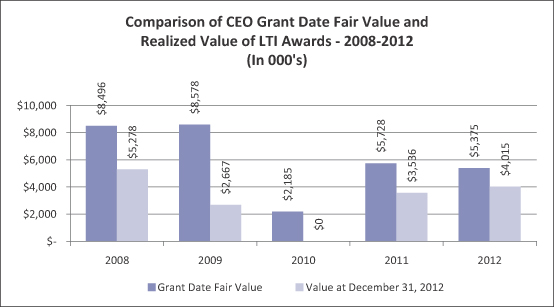

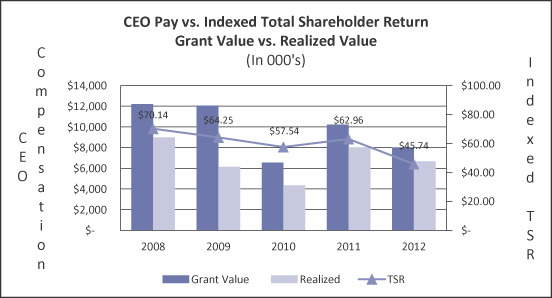

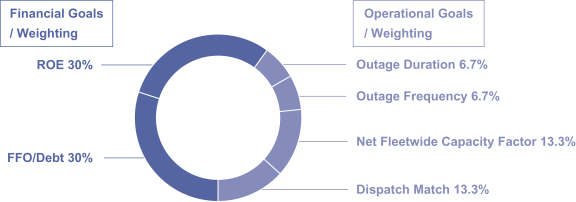

Board Oversight of RiskBOARD OVERSIGHT OF RISK